The Good, The Bad, and The Ugly

Look, I know y’all came here to learn about sexy topics like Proto-Danksharding, but it’s clear that regulatory, legal, and political developments are dominating crypto right now so today’s issue will focus there again. The Good: Coinbase fights back against the SEC. The Bad: Tron and Binance definitely aren’t helping. The Ugly: Crypto is veering partisan, just like everything else.

Programming Note: I’m skipping the next regularly scheduled Crypto Curious as I will be in Japan inspecting manhole covers. Instead we will have a special mailbag edition! If you have any burning questions or just want to defend your employer from my libelous commentary, send your questions or commentaries and I’ll see what I can address. If no one sends anything in, I’ll just share cute dog videos so, you know, win win.

🟢 The Good (?): Coinbase Goes to the Mattresses

On March 22, Coinbase announced that they had received a Wells notice from the SEC. A Wells notice is an indication that the SEC is about to bring an enforcement action, essentially a shot across the bow of the most reputable, most regulated and most compliant crypto company in the U.S.

When you hear Coinbase’s side of the argument, you can see why they might be frustrated:

Last year, Gary Gensler quoted the first SEC commissioner saying, “No honest business need fear the SEC” and then went on to say, “come in, talk to us, and register.” Well, apparently, Coinbase had 30 meetings with the SEC in the last nine months and claims they received zero feedback on “what to change or how to register” prior to receiving a Wells notice.

When Coinbase filed to go public in 2021, their IPO was approved by the SEC in spite of clear disclosures of business practices that are now apparently objectionable. I understand that approval of an S-1 is focused on disclosures in a specific context, but it still seems odd the SEC would approve a business it believed was selling illegal securities and while also allowing the public to invest in such a company before revealing that it was, in fact, a criminal enterprise.

Coinbase is already regulated by the CFTC, the NY Department of Financial Services and dozens of other countries including Singapore, Ireland, Australia, and Germany.

And while the mere threats of regulatory action have been effective in the recent past (e.g. Kraken cracking in February), Coinbase has decided there is no longer any point in trying to cooperate with regulators that they feel are acting in bad faith. Per Brian Armstrong, the Coinbase CEO:

“While we understand that this is all part of the journey to reforming our financial system, we are right on the law, confident in the facts, and welcome the opportunity for Coinbase (and by extension the broader crypto community) to get before a court.”

Coinbase is kind of like Hermione Granger: works hard, studies her ass off and a bit of a know it all. Hermione really wants to do the right thing and is inclined to obey authority, but things get worse and worse and next thing you know, Elizabeth Warren Doloroes Umbrige is ruining everything and Hermione sets out on a treacherous journey to destroy Gary Gensler Voldemort.

Until recently, the perspective of most genuinely legit crypto companies was that, yes, the U.S government should go after cheats and scams, but we will work with them to create a path for fair, legal operations. Instead, the SEC in particular, has gone after anyone and everyone. It's become clear in the past six months that the preference is to shut it all down rather than create a path for smart, compliant products. With no real options left, the industry is now fighting back.

This will set up an interesting battle. Coinbase is a well funded, well operated public company. It will take years to settle the case in courts, but it will all play out in public surely influencing and shaping opinions and policies along the way.

🟦 The Bad: Welcome to Raccoon City

The same day the Coinbase announced they had received their Wells notice, the SEC brought another crypto case, this one against Justin Sun and his Tron Foundation, plus eight celebrities, including Lindsay Lohan, Soulja Boy and Lil Yachty. And while charges could have run the gambit from unbearable cuteness to wildly inappropriate lyrics over catchy steel drums, this case is a much more straightforward prosecution of market manipulation, illegal promotion and fraud. The SEC alleges that Tron sold two unregistered securities (the TRX and BTT tokens) and manipulated those markets through wash trading. All but two of the celebrities settled (paying a total of $400,000 in fines) for not disclosing they were paid for promoting these tokens.

Fair enough. That's the kind of enforcement I would hope to see from the SEC. I always think of a spectrum of tech executives. On one far end is Steve Jobs, who certainly would pitch a bold vision of the future, but pretty much always backed it up with actual product. On the other end is Elizabeth Holmes, who pitched a vision that was backed by pure fraud. It’s a fun parlor question of where you might put Elon Musk on that spectrum (and I know I have him a little closer to the Theranos side of the ledger than most people). But in a crypto world that is clearly populated with far too many Elizabeth Holmeses, I constantly find myself evaluating where someone falls on this scale. Justin Tron is pretty far on the raccoon side so not only am I not worked up if he gets charged, I’m relieved.

Days later, the Commodity Futures Trading Commission (CFTC), which regulates options and derivatives, charged Binance and Changpeng Zhao (CZ) with operating illegally in the U.S. and knowingly offering products to U.S. citizens.

The allegations were salacious:

Binance made the bare minimum effort in barring U.S. customers and encouraged users to use VPNs to hide their location: “Binance’s VPN guide also hints: ‘you might want to use a VPN to unlock sites that are restricted in your country.’”

CZ suggested, in writing, not to put anything in writing, “Give them a heads up to ensure they don’t connect from a US IP [address]. Don’t leave anything in writing.”

Binance execs openly acknowledged that they worked with Hamas (but only in “small sums”) and customers from Russia that are “here for crime.”

And it turned out if you were a big enough customer, Binance will give you a heads up if the po-po is on to you: “VIP team is to contact the user through all available means (text, phone) to inform him/her that his account has been frozen or unfrozen. Do not directly tell the user to run, just tell them their account has been unfrozen and it was investigated by XXX. If the user is a big trader, or a smart one, he/she will get the hint.”

I suppose there is a certain take that this isn’t quite as horrible as it seems. Matt Levine took a little bit of that angle:

“There are no accusations that Binance is stealing customer money, or even taking big risks with it, which makes Binance look better than some other crypto exchanges I could name… The CFTC’s complaint here gestures at traditional regulatory concerns like retail customer protection and cracking down on money laundering. But it is mostly about cutting off a big international crypto exchange from big sophisticated proprietary market-making firms in the US… The financial world is interconnected, and everything touches the US at some point, and US regulators have become experts at using that fact to get jurisdiction over the whole financial world. And now they are coming for Binance.”

Honestly, a Binance prosecution wasn’t a big surprise either. In the carnage of the last six months, CZ has tried to fill the role of the calm, elder statesmen encouraging peace and love in the crypto community. But from the earliest days, Binance’s background, operations and tactics have been murky at best. The fact that they refuse to disclose the location of their executive offices make it pretty clear that they prefer not to be subject to regulation in any one country and perhaps prefer to operate based on some vague form of Sky Law.

There’s zero doubt that Binance offers dozens of products that would, in the U.S., be regulated by the CFTC. And I suppose if you do business outside of the U.S., you don’t have to follow U.S. laws and you can do business with whoever you like, no matter how unsavory. But it’s also pretty reasonable that if you touch Americans, you can expect pushback for not following U.S. laws.

Alternatively, this is what happens when the U.S. fails to engage with the world: exchanges, trading activity and liquidity gets pushed abroad into places like FTX and Binance where the U.S. has fewer levers to control and influence the outcomes.

◆ The Ugly: A Muddled Mess

Of course, there are fun details in these suits. While the SEC is claiming everything is a security, the CFTC in claiming authority over Binance specifically calls Bitcoin, Ethereum and at least some other tokens commodities. As summed up by the wise “hentai anime penguin in a suit”:

"Crypto in the United States right now is like some sort of Schrödinger's cat where it is either a security or a commodity depending on which 3 letter agency wants to sue you."

The Coinbase CEO added:

"Imagine you've got both football and soccer refs on the field, but we're actually playing pickleball (fastest growing new sport in America). The refs can't really agree on the rules of this new game, and one of them decides to change a call they made back in April 2021."

There’s also some nice irony in the fact that while one part of the U.S. government is trying to kill Coinbase, a different government arm is transferring $217 million of seized Bitcoin to Coinbase to sell for them.

Meanwhile, things are getting uglier on the political front as there are increasing signs of partisanship coming to crypto. Elizabeth Warren has made a hatred of crypto her rallying cause and this week announced that she is “building an anti-crypto army”:

Twitter, of course, found the next image she can use:

The phrase “anti-crypto armies” doesn’t feel like it leaves a lot of room for nuance about the values of decentralization and composability, but perhaps that’s to be expected from a 73-year-old Senator from a safe state?

Meanwhile, Florida Man announced legislation to ban central bank digital currencies (CBDCs) from our nation’s most interesting state. Now, without getting into all of the details, I generally agree with DeSantis that CBDCs are broadly a bad idea. Allowing the government to see every transaction and program money however they like (i.e. your money expires or is automatically taxed) is not my personal jam. But claiming that you are “protect[ing] Floridians from the Biden administration’s weaponization of the financial sector” is also not leaving room for a balanced discussion of the pros and cons.

I think the takeaway is that we are now entering the “messy middle” of crypto’s evolution. As the technology evolves and starts to mature, people are picking sides for political points, economic gain or defensive purposes. My hope, and my goal through this newsletter, is that as people learn more about crypto, its strengths and weaknesses and its potential, there will be more open minded about the possibilities. I continue to believe that the principles of crypto resonate deeply with the ideals that the U.S. was built on and that, over time, these will win out. But it’s clear that the next few years will be messy.

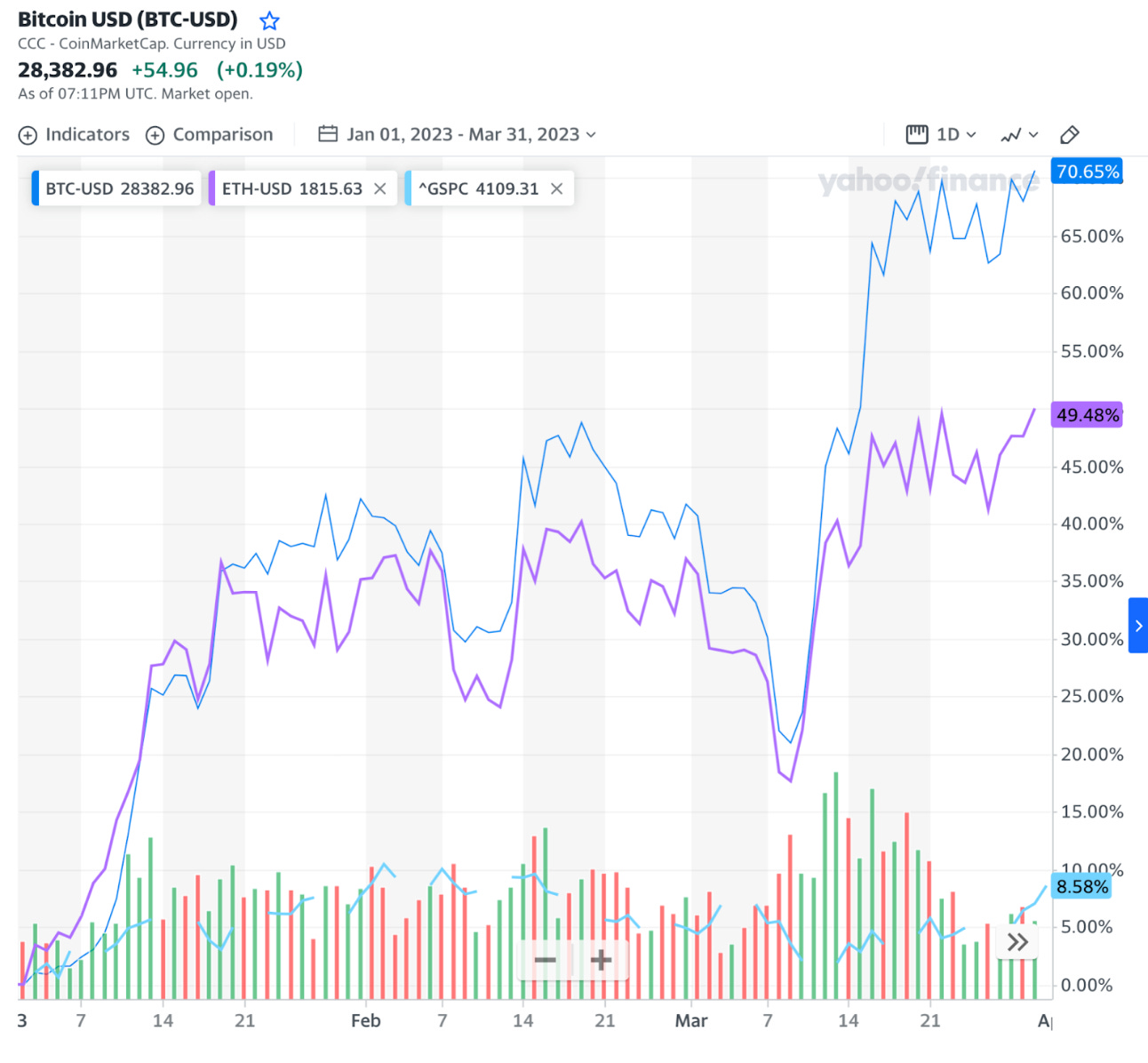

Interestingly, throughout all of the negativity of the past quarter, Bitcoin is up 70% and ETH is up 50%.

Bitcoin, in particular, seems to have some appeal during banking stress. “Every day it doesn’t die, it gets a little bit stronger.”

This Week's Freezing Cold Take

Lots of smart people can’t see the future :

“500 dollars? Fully subsidized? With a plan? I said that is the most expensive phone in the world. And it doesn’t appeal to business customers because it doesn’t have a keyboard. Which makes it not a very good email machine.”

-Steve Ballmer

As always, thanks for reading. Send me questions and please share with your crypto curious friends.