Happy Days Are Here Again

Ha! You thought you were rid of me, didn’t you? Yeah, I over heard you at that Christmas party, saying crypto was dead, flirting with that GPT chatbot. Look, I know it sounds like she’s into you, but it’s not real. She’s just telling you what you want to hear. What we have, what we have is real. We’ve got over collateralized lending, we’ve got decentralized file storage, we’ve got CryptoDickbutts. No, wait, wait, come back! We’ve also got green candles!

Solana up 75% in the last week, BTC and ETH up 24%. We’re back, baby!

🟢 Too Little, Too Late

(Big Idea: Regulation)

Y’all seemed to love the FTX drama and it’s been a month so let’s check in on everyone’s favorite villain:

Last we left off, Sam Bankman-Fried has just been arrested in the Bahamas. He was extradited to the U.S. surprisingly quickly, arraigned in New York and then released on bail announced at $250 million. That seemed like quite a large number for a guy who claimed to have $100K left in his checking account, but apparently, his parents just vouched their house (estimated at around $4 million) and then are allowed to just say they are good for the other $246 million if he jumps bail. Fingers crossed that we get to that episode.

Caroline Ellison, former head of Alameda, and Gary Wang, co-founder of FTX, both pled guilty in Federal court and agreed to cooperate with prosecution. Her public comments were limited, but she confessed that she knew customer funds were used to finance loans to Alameda. It has come out, for example, that Alameda had a handy $65 billion credit line from FTX that was hard coded by Wang.

There were reports that the FTX case is “so sprawling that it could exhaust resources of the Southern District since it includes potential bribery, campaign contribution violations, market manipulation on top of theft & fraud.” So, you know, good to know that Bankman-Fried can inflict losses in all kinds of dimensions.

In good news, bankruptcy lawyers located more than $5 billion in cash and liquid assets along with illiquid assets with a book value of $4.6 billion. That caused some to get more enthusiastic about recovery, but FTX claims are reportedly selling for 13.5 cents on the dollar.

In the midst of this, Bankman-Fried decided that now was a good time to launch a Substack. Oy vey. “I didn’t steal funds, and I certainly didn’t stash billions away,” blah blah blah. My personal favorite was a table that added up $104 billion in Alameda assets, but was labeled “JUST AN ESTIMATE”. No, wait, the best part was when he graciously “offered to contribute nearly all of my personal shares in Robinhood to customers–or 100%, if the Chapter 11 team would honor my D&O legal expense indemnification.” If you recall, Bankman-Fried bought 7.6% of Robinhood for $648 million just six months before FTX blew up. I’m quite sure the money for that purchase came from Sam saving up Christmas gifts from his Nana.

And just for good measure, Tom Brady and Giselle (Brazilians only need one name), who featured in an FTX ad where they rounded up all of their friends to trade on FTX (“I’m in”), owned shares in FTX worth a combined $70 million. Poor guy just can’t catch a break.

Meanwhile, in other prosecutions, the SEC charged Genesis and Gemini for the “unregistered offer and sale of securities to retail investors through the Gemini Earn crypto asset lending program.” Of course, the Earn program was shut down two months ago in midst of the Genesis/DCG contagion that we’ve talked about in the last two issues.

As Tyler Winklevoss (the cuter of the Winklevi) explained, Earn was regulated by the New York DFS and had been in talks with the SEC for 17 months about the Earn program. He described the SEC’s actions as “super lame.” Strong words indeed, but I’m likely to agree. The ongoing criticism of the SEC’s regulation under Gary Gensler is that they have shared nothing proactive or forward looking, set no definitions or guidelines and have merely punished things they dislike after the fact. Meanwhile, consumers are suffering real harm from permitted products like GBTC (more on that in a bit). Gensler has been under pressure even before the FTX debacle so it will be interesting to see if the new Congress changes anything.

🟦 We Mastered Crypto Regulation in the 1930s

(Big Idea: Super Lame Regulation)

While Genesis is getting sued by the SEC, its parent company, DCG is still embroiled in controversy. Genesis and Gemini, the above co-defendents, are locked in an increasingly public battle over Genesis’ loan losses. We talked a little bit about this previously, but it’s all quite complicated and made all the more confusing that the two companies start with “Ge” and otherwise sound semi-similar (I think like with a baseball team, if two people’s names are too close one has to go by a new nickname).

Anyway, DCG also owns Greyscale which offers publicly traded trusts that hold crypto assets. If you want to own crypto in a brokerage account, this is basically the only way to do it. But it also happens to be a really crappy way to do it.

When mutual funds first came to the U.S. in the 1890s, they were “closed-end” funds. The fund held certain assets and then issued a fixed number of shares which would freely trade. Depending on investor interest, they might trade above or below “net asset value” and oftentimes might hold illiquid investments that are harder to value on a day to day basis.

The first “open-ended” fund launched in 1924. In general, open-ended funds set a value once a day and then investors can buy or sell at that price. New shares can be issued and old ones redeemed, perhaps subject to some limitations, but because they get priced each day, prices track net asset value closely.

ETFs (exchange traded funds) came along in the early 1990s and are even more precise instruments. ETFs act like stocks so you can trade them anytime when the markets are open, not just once a day. They also have a unique creation/redemption method that allows conversion between the ETF and the underlying assets. So an arbitraguer can take their shares of the SPDR S&P 500 ETF and say, “Here’s 50,000 SPY shares, now give me 8,851 shares of Apple and 4,421 shares of Microsoft etc. etc.” This ensures that the price of the ETF very precisely tracks the value of the holdings. And the competitiveness of the ETF market ensures that fees are very low. For example, the expense ratio on SPY is just 0.09%.

So, wow, that ETF thing sounds way better than the other options, let’s do that for crypto. Uh, no. The SEC says you can’t. Why? Because Bitcoin is “prone to fraud and manipulation.” But, wait, they approved a futures based Bitcoin ETF and then a leveraged Bitcoin futures ETF. Why? Because those futures trade on markets regulated by the CFTC so that means they are safe for investors. Even if the futures markets 99.9% match the spot Bitcoin market. Even if you’re using leverage to invest in volatile assets. And even if the returns constantly get eaten away by the cost of holding futures. That is somehow better for investor protection.

Anyway, that means that crypto is set back to our 1890s fund structure. Greyscale currently offers 17 closed-end crypto funds that you can buy in your Schwab brokerage account or your Vanguard Roth IRA (I actually know a guy who writes a newsletter who did this; such an idiot). The Greyscale Bitcoin Trust is the largest with $13B in assets under management, followed by an Etheruem trust ($4.3B AUM), but you can also buy a crypto “Large Cap” fund or specialized funds for Decentraland (virtual land) or Filecoin (decentralized storage).

There are two big problems. The first is the fees. The Bitcoin trust charges a 2% management fee while every other Greyscale fund charges 2.5%. [Quick advice, 2% is a bargain for a smart, insightful & handsome crypto analyst, but 2.5% is a lot for a mix of 65% Bitcoin and 30% ETH.] While it is admittedly harder and more expensive to hold crypto than traditional stocks and bonds, even an ETF that holds actual, physical gold only charges 0.40%. Greyscale rakes in $260 million in fees each year and doesn’t even have to spend money redeeming anything. The increased rake on the Ethereum fund means that it makes over $100 million in fees and they don’t even give investors the 4% they should be earning from staking.

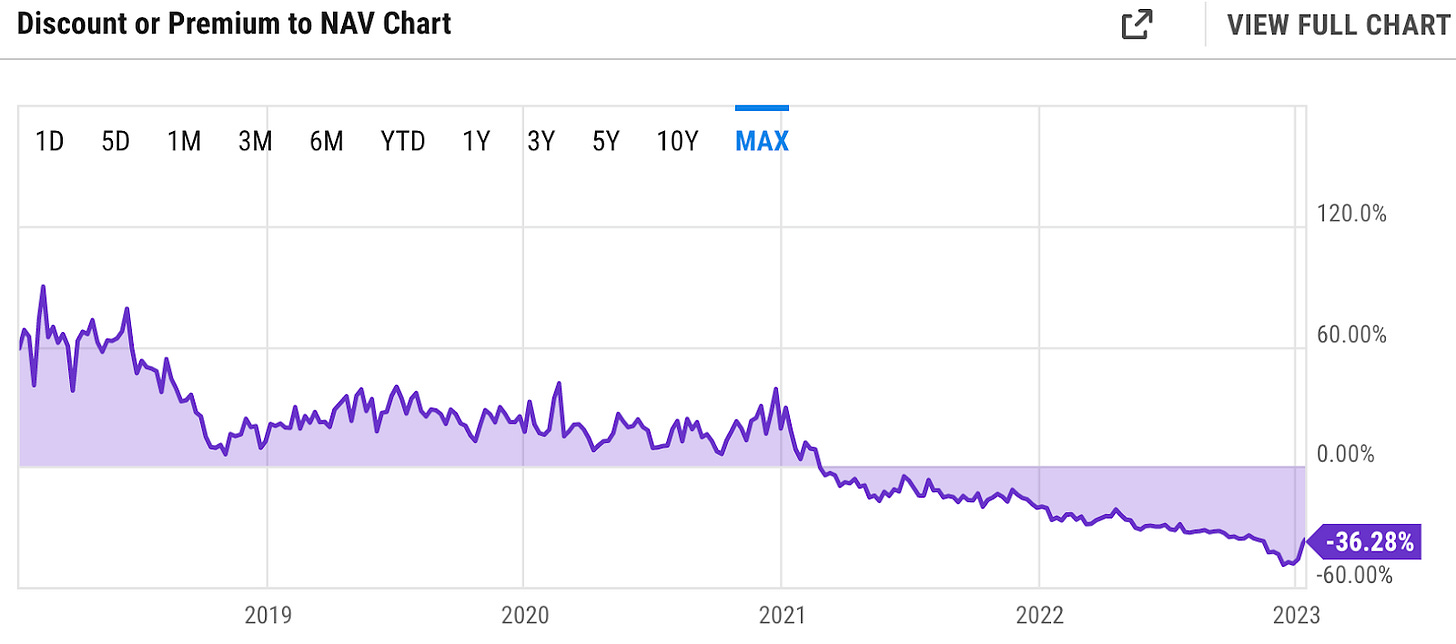

The second problem is that the lack of redemption options means that for most of these funds history, they have traded at a major discount to the assets they hold. In early days, when investors either had fewer options to hold Bitcoin or were just generally more ebullient about getting in, GBTC traded at a premium to the underlying value:

In those days, Greyscale was eager to create more GBTC shares, but now that the premium has flipped to a discount, there is no (easy) way for them to redeem these shares to close the gap. Just before Christmas, this discount reached an all time low of -48.89%. That meant that even if Greyscale was holding $12 billion of Bitcoin, the market was valuing that Bitcoin at just over $6 billion. Why? Because the assumption is that Greyscale will suck all the value away in fees before investors can ever get at the underlying Bitcoin.

The result is a mess. The GBTC discount has resulted in dozens of funds waylaid by trying to arbitrage that gap. Greyscale is actively suing the SEC over its refusal to approve a spot ETF, but not surprisingly, they have not yet sought out other methods to redeem shares (you can Google “Regulation M exemption” should you want to learn more). Meanwhile, investors pay $400 million in excess fees per year and have to trade in distorted markets in the name of “investor protection.”

◆ Bitcoin On Ice

(Big Idea: Energy Usage)

Crypto broadly comes under criticism for being an energy hog. With the exception of Bitcoin, and that is a big exception, this criticism is largely outdated. We discussed the “Merge” many issues ago and with that momentous change, Ethereum became 99.95% more energy efficient. Almost all current blockchains run on some form of Proof of Stake and, as such, are within range of AWS in terms of energy consumption.

Bitcoin, however, remains Proof of Work and is likely to stay that way for quite some time if not forever. Proof of Work, almost by definition, burns energy as a way to prove that a transaction is real. And if one thinks of Bitcoin as something precious like gold or diamonds or air conditioning in Texas and Florida, then some people are like, “Well, dem’s da breaks.” Valuable things use energy.

There’s wild debates about how much energy Bitcoin actually uses (some estimates put it in the ballpark of Halloween costumes or tumble dryers), but what is unique about Bitcoin’s energy usage is that it doesn’t care about where and it can be uniquely flexible about when. We’ve learned through blackouts in Austin and challenges with electric cars that electricity is hard to transport over large distances and is extremely expensive to store and transport across time. Bitcoin mining equipment, however, can be located anywhere in the world there is power and an Internet connection, opening up unique opportunities.

For example, when Bitcoin mining was still allowed in China, there would be a physical migration of servers based on which regions had abundant electricity. During the flood season, hydroelectric power was cheap in Sichuan so mining operations would move there. Then, once the rain stopped, miners would move north to take advantage of lower cost thermal and wind power.

Exxon and other traditional energy companies have started programs to use natural gas that would otherwise be burnt off into the air to instead power remote Bitcoin mining machines. For years, Iceland had attracted huge Bitcoin mining farms due to cheap, renewable geothermal.

But time-shifting electricity demand has had some interesting benefits as well. Texas has created a program for “Large Flexible Loads (LFL)” such that when the power grid is under stress, Bitcoin miners get cut off first, returning that power demand to the grid for other, more critical uses.

Even without these programs in place yet, we saw this exact pattern at work during this year’s Christmas polar blast:

As temperatures dropped across the U.S., electricity prices rose and Bitcoin miners went offline. The Bitcoin global hashrate (an inferred measure of how much processing power is currently online) fell by 40%. Then, as temperatures warmed up again and the grid returned to normal, those miners came back online and network performance returned.

Bitcoin will continue to suffer from environmental concerns, but its unique patterns where it doesn’t care where it is located and only sort of cares about when it is online helps mitigate the real impact, even if the nuance is often lost in the debate.

This Week's Burning Hot Take

Did you know that Martin Luther King predicted an African-American president in the "not-too-distant future"? That was a hot take. But today, I always think of both the sad and hopeful predictions in his last speech:

As always, thanks for reading. Send me questions and please share with your crypto curious friends.