Down Goes Frazier!

Guess who’s back? Not me. I never actually left and will always be here for all of your crypto curiosities. But crypto is slowly regaining some steam. After getting pummeled in the last twelve months, crypto has quietly built some momentum with a series of wins in the past few months.

In the words of the bard of our times:

So the FCC SEC won't let me be

Or let me be me, so let me see

They tried to shut me down on MTV NYSE

But it feels so empty without me

[Next two lines redacted.]

And get ready, 'cause this shit's about to get heavy

I just settled all my lawsuits (F*&@ you, Debbie Gary!)

I gave you all summer to catch up on your Nantucket beach reads, but now it’s time to dig in.

🟢 Play Time is Over

The quest for a Bitcoin ETF has gone on nearly as long as a Lord of the Rings movie. The first application was back in 2013 by the Winklevii when Bitcoin was trading at $88.05. In fact, one of the first issues of Crypto Curious discussed the SEC denying Grayscale’s attempt to convert their closed-end fund into an ETF (we’ll come back to that shortly). Many have piled in over the years: VanEck in 2020, Fidelity, Invesco and Kathy Wood’s ARK Fund in 2021.

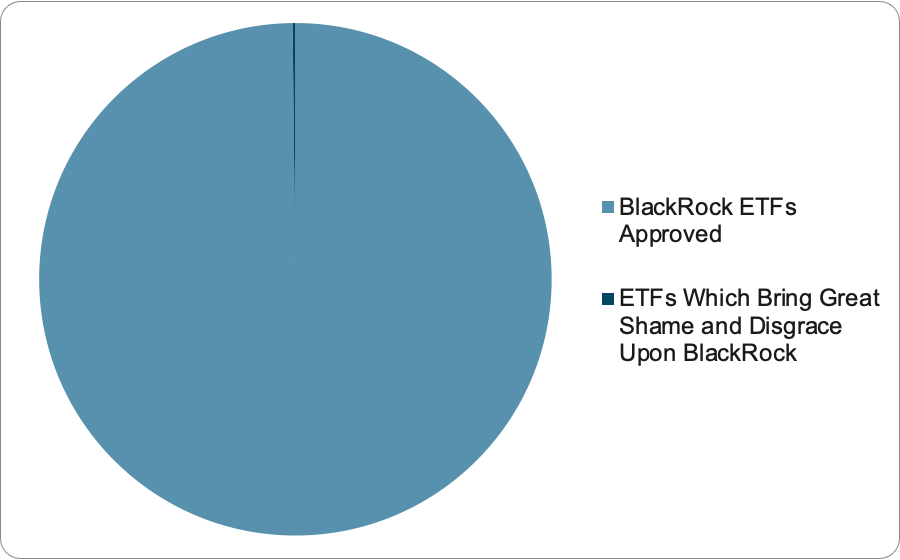

But ears perked up this summer when BlackRock filed for their own Bitcoin ETF. With $9 trillion in assets, BlackRock is the largest asset manager in the world. BlackRock is also known for very strong ties to Washington D.C. across the political spectrum so many observers something was afoot with their timing. They also have an impeccable track record with getting ETFs approved. Of the 576 ETFs that Blackrock has applied for, 575 of them have been approved. For the visual learners out there, I’ve charted it for you:

Why does it matter? Well, despite progress, it still remains relatively hard to buy and hold Bitcoin, much less Ethereum or other crypto products. You can:

Not be American. Canada, Germany, Switzerland, France, Australia and Singapore have approved spot Bitcoin ETFs.

Open a dedicated crypto account. You’ll need to fill out some applications, pick a good, strong password and do a bunch of KYC so at least you have a fun activity for your Sunday afternoon. Coinbase is by far the biggest crypto custodian in the U.S. and they have $128 billion in assets on their platform which kinda sounds like a big number, but turns out to be 1.6% of what Schwab has.

Buy shares in a Bitcoin trust like GBTC run by Grayscale. These trusts hold a big pie of Bitcoin and shareholders kinda sorta have a claim on those Bitcoin but can’t actually ever redeem them (which is the whole part that makes an ETF work). It’s a bit like taking a reservation, but not actually holding it. These trusts (which also exist in about 17 other flavors of crypto) trade in slightly odd over-the-counter markets, they don’t actually track the actual price of Bitcoin (sometimes higher, but consistently much lower for the past three years) and cost 2% for the privilege.

Buy a Bitcoin ETF based on Bitcoin futures. BITO received SEC approval in 2021 because it is based on futures traded on an SEC friendly platform, but investors lose 5-7% a year because of the cost of futures.

Even for institutions, all of this is similarly complicated. And 401(k)s ($7 trillion of assets) and IRAs ($12 trillion) are almost completely shut out from investing in crypto. It’s improving slowly, but while most capital (at least in the U.S.) can easily flow into shares of Apple, getting Bitcoin exposure is difficult. So almost as long as Bitcoin has been around, proponents have expected that the launch of a spot (i.e. non-futures based) ETF would open the floodgates for whole new realms of capital.

🟦 Down Goes Frazier!

Sure enough, however, that day may come soon. This week, Grayscale won a major judgment against the SEC won and a Bitcoin ETF looks, if not imminent, then at least highly likely to happen in the near term (Bloomberg’s ETF experts now have a 75% chance of a Bitcoin ETF launching this year and 95% by the end of 2024).

Grayscale had been repeatedly denied permission to convert GBTC into an ETF, so last June they filed suit in federal court. On Wednesday, in a highly unusual rebuke, the court voted 3-0 in Grayscale’s favor and vacated the SEC’s denial which they called “arbitrary and capricious.”

The judges were not particular kind to the SEC:

“The Securities and Exchange Commission recently approved the trading of two bitcoin futures funds on national exchanges but denied approval of Grayscale’s bitcoin fund.”

“The Commission neither disputed Grayscale’s evidence that the spot and futures markets for bitcoin are 99.9 percent correlated, nor suggested that market inefficiencies or other factors would undermine the correlation… The Commission’s unexplained discounting of the obvious financial and mathematical relationship between the spot and futures markets falls short of the standard for reasoned decision making..”

This does not mean that GBTC can immediately convert or that the other ten Bitcoin ETFs in the queue are automatically approved. It just means that the SEC will have to change the reasons for their denial. At this point they can:

Un-approve the existing Bitcoin futures based ETFs. This seems unlikely.

Come up with new reasons to deny a Bitcoin ETF. This would most likely have something to do with custody objections.

Use this as a semi-graceful opportunity to say, “Eh, we don’t really agree, but if the DC Circuit wants to screw over investors, who are we to stop them?”

Post FTX, I might have thought that the SEC would come up with some new reasons for denial as they’ve shown some solid creativity in the past, but now I think a graceful exit is a bit more likely. This ruling got pretty extensive coverage in the NYT, WSJ, and CNN amongst others and this may not be the situation to double down given the SEC’s shaky ground.

◆ Ripple Effects

Especially since six weeks earlier this summer, the SEC took another “L” in court as U.S. District Judge Analisa Torres ruled against the SEC in their case against Ripple. In the last days of the Trump administration, the SEC sued, claiming Ripple violated investor-protection laws when it sold its XRP token as an unregistered securities offering. “If other courts follow this reasoning, that is a major problem for the SEC,” said Marc Fagel, a former director of the SEC’s San Francisco office.

Matt Levine summed it up best (as he always does):

Basically she [Judge Torres] ruled that sometimes XRP is a security and sometimes it isn’t. When Ripple sold XRP to institutional investors in over-the-counter trades, with due diligence and investment agreements, that was an “investment contract” and so a securities offering. When Ripple sold XRP to retail investors in on-exchange trades, anonymously and with no disclosure, that was not an “investment contract” and so not a securities offering.

That’s so weird!

Look, despite sorta knowing some of the people at Ripple, I wouldn’t quite call it a scam, but it’s perhaps a bit too scam adjacent? I would definitely say that for having a $26 billion market cap (the 4th largest crypto market cap) and having made a lot of insiders insanely wealthy, I would have liked to have seen way more progress out of them. XRP kinda sorta sounds like a security to me and it’s been pretty heavily marketed with a suspiciously strong social media fan base.

As a broadly pro-crypto dude, this is not the case I would hang my hat on. Ripple is a long way from FTX, but also has not been a great representative for the crypto industry. Judge Torres’ ruling also seems shaky and I think there are valid questions of if it will hold up. But it is notable in providing another roadblock on Gensler’s March to the [Crypto] Sea.

More recently, on Thursday crypto notched another less noticeable, but significant win in U.S. District Court for the Southern District of New York (SDNY). Judge Katherine Polk Failla dismissed a class-action lawsuit against Uniswap, a decentralized exchange. The plaintiffs lost money on a number of scam tokens that they purchased via Uniswap, blaming the platform for their losses on these “unregistered securities.”

Judge Failla compared the accusations to holding a self-driving car developer liable for a driver who used the vehicle to rob a bank. She further compared it to “attempting to hold an application like Venmo or Zelle liable for a drug deal that used the platform to facilitate a fund transfer.”

This has been an ongoing issue around crypto as an emergent and unique technology that may not fit into existing frameworks. We accept that Verizon is not responsible for illegal activity that takes place on calls over its networks. Section 230 protects Internet platforms from liability for what their users post. Even gun manufacturers cannot be held liable for the use of their products in a crime.

To many crypto enthusiasts, these same principles should apply to the protocols and blockchains that power crypto (i.e. regulate and monitor the edges, not the middle). But to this point, many regulators have gone after the code itself and the issue has not been definitely settled. Many are encouraged that this ruling may help establish some precedent.

It is also encouraging that Judge Failla and, indeed, many of the judges ruling on these cases, seem to understand some of the nuances and subtleties of crypto. Crypto can be a weird hybrid of lots of different models and it requires a bit more time and effort to deeply understand. We’ve seen a number of politicians who seem unable or unwilling to invest in learning about the technology, but so far the Federal judges have been much more open minded. It is also worth noting that Judge Failla is also presiding over the SEC vs. Coinbase litigation, a case that could end being widely impactful in its final ruling.

Crypto is hardly out of the woods in the regulatory arena, but it has been encouraging to see the judicial system provide a counterbalance to some aggressive regulation.

This Week's Burning Hot Take

“Listen my man, I just need some liquidity... I just ran into some bad subprime.”