Boom Goes the Dynamite

Dude. Duuuuuuddee. It’s been a rough seven days and I’m nervous to hit send since I have no idea what more drama may yet unfold around the FTX/Alameda debacle. I normally try to not just regurgitate crypto news since there are clearly many other outlets faster and better at that. A bit of recap will be necessary this time, however, and then we’ll get into where we are now at and where things might be heading.

In the meantime, not financial advice, but some quick notes if you hold crypto assets currently:

Coinbase and Kraken are probably the exchanges most likely to be stable going forward. If you have assets elsewhere, especially Crypto.com, please consider moving to self-custody or another exchange.

If you hold any Tether (UDST), I would unload that into USDC to be safe. We haven’t heard anything new about their solvency, but there is much reason to be skeptical.

If any of you want help with any of these steps or setting up cold storage, please reach out.

Also, quick disclosure on my biases and holdings in relation to this. I had no direct exposure to FTX. I trade with Kraken (mostly because of their proof of reserves which we will discuss in future issues) and I self-custody most all of my assets. My model fund portfolio that I’ve been tracking since June held no FTT or Binance or Cronos. I have used LedgerX in the past to write covered calls, but mostly stopped using them coincidentally around the time FTX purchased the site.

Anyway, on to the sh*& show.

🟢 What Happened

There’s so many just plain weird aspects to the FTX story and random tendrils reaching into dark nooks and crannies that we’ll just try to stick to the highlights. Setting the scene:

FTX was roughly the second largest crypto exchange in the world, in a clump with Coinbase and a bunch of exchanges you’ve never heard of. Binance, based in Asia, is by far the biggest.

FTX was founded just three years ago by Sam Bankman Fried, universally known as SBF.

FTX grew out of Alameda Research, a trading firm that traded its own book and also became a big market maker.

Alameda and FTX had an extremely close relationship. Even in the best of times, no one quite knew where FTX ended and Alameda started. While I’ll try to steer clear of the alleged drug use and amorous tales, it is relevant that SBF and Caroline, the Alameda CEO, dated through much of this time.

In its short history, FTX raised $1.8 billion, the most recent round at a $32 billion valuation. FTX’s investors is a gold list of investors: Sequoia, NEA, IVP, Mayfield, Lightspeed, Ribbit, etc. etc.

Yet in one week, it all collapsed and approximately $8 billion of customer money was lost somewhere, shot “into some still-unexplained reaches of the astral plane.”

Here’s how it unfolded:

On November 2, Coindesk published a version of Alameda’s balance sheet. How Coindesk obtained it remains unknown, but it doesn’t seem accidental that it was leaked. What it revealed was concerning. Alameda claimed $14 billion in assets, but almost $6 billion was in the FTT token, essentially a magic money invented by FTX. Much of the other assets were either other volatile crypto assets or just vague “investments.”

As concern started brewing, Changpeng Zhao, the CEO of Binance know just as “CZ”, effectively shanked FTX. Binance, despite being a competitor, was also an early investor in FTX and held 23 million FTT tokens. Relations had frayed and it didn’t help that SBF recently sent a snide Tweet targeting CZ. November 6 CZ announced that Binance would sell all of the FTT they held, worth about $529 million at the time. This put immediate pressure on the FTT token price.

Over the weekend, FTX depositors started getting the hell out. Apparently, FTX processed $6 billion in withdrawals. This was perhaps 40% of FTX’s deposits.

Caroline, the Alameda CEO, publicly offered to buy Binance’s shares for $22, effectively stating a price they would defend. But on November 7, the price broke through and fell to $16. Customers continued to flee.

The next morning, FTX stopped all withdrawals. SBF announced that Binance would be stepping in and buying FTX. CZ poked around for a day, saw what a mess it was and then peaced out. FTT fell to $4.

Somewhat shockingly, FTX turned out not to have retained virtually any customer funds. Now that their own token was close to worthless, they had effectively no liquid assets left. They submitted a bankruptcy filing covering more than 130 corporate entities the morning of November 11. A $32 billion empire destroyed in between issues of Crypto Curious.

Oh, and by the way, after FTX went into administration, someone “hacked” their accounts and took $600 million or so. I find it hard to believe this wasn’t an inside job, but in the midst of everything else happening, most everyone has just skipped over this part.

News is still trickling out and it will take years to learn the full story, but the blast hole is hard to comprehend. At first, many just assumed it was a liquidity issue like a traditional bank run. Banks have short-term deposits and long-term loans and even if they have plenty of money, they might not have enough cash on hand at a specific moment if everyone wants their money back as George Bailey explained.

But FTX isn’t a bank, it’s an exchange. If I have 10 Bitcoin in my FTX account, the assumption is that FTX is just holding my 10 Bitcoin for me. They make their money on trading fees, not fractional reserves. They shouldn’t be making mortgages with my Bitcoin, much less lending it to a trading firm.

[Sidebar: Now, of course, Schwab and Robinhood and basically every brokerage actually are allowed to do what they want with your stocks. If you have a margin account, buried in the legalese, you “grant authority to the brokerage firm, acting as principal or otherwise, to pledge, repledge, hypothecate or rehypothecate assets.” “Rehypothecation” is a good word to be aware of, but it means that Schwab can take your Tesla, Amazon or AT&T shares and use them as their own collateral to take out another loan. But we’re cool with that since Schwab is nice and trustworthy, the regulators would never let anything bad happen and none of this has blown up for at least 11 years so we’re good.]

With FTX, there was certainly an asset-liability duration mismatch. FTX had made 255 (!) venture investments that were on the books for around $2.5 billion.

That money may or may not ever come back, but it clearly wasn’t liquid for customers to withdraw. [They also apparently put $7.5 million on a bet that Trump would lose in 2024.] But if FTX was actually solvent instead of just illiquid, perhaps they may have survived.

But the hole went way far beyond that. The best we can tell, another $6 billion has just sort of evaporated. Much of it was spent on lobbying: SBF gave $32 million to Democrats in this most recent cycle; one of his partners gave $20 million to Republicans. Some of it went to have Bill Clinton and Katy Perry come to a conference. Other amounts went to Tom and Giselle to do ads and hang around and be beautiful.

As for the rest, the best guess is that FTX loaned it all out to Alameda and Alameda lost it. Some people just think Alameda was actually really, really bad at trading and basically subsidized everyone else for the duration of their existence. And when you hear Caroline talk about their trading strategies, this becomes easier to believe. Some suspect that much of it was lost in Terra/Luna when that ecosystem went to zero in May. It’s unclear how long Alameda was in bad shape, but there is some on-chain evidence that FTX transferred what was then nominally $4.8 billion of FTT tokens to Alameda to use as collateral in that timeframe.

🟦 Where Are We Now

1) This was fraud. The behavior was criminal. This wasn’t just, “we tried something and it didn’t work out.”. The U.S. Department of Justice is investigating along with the SEC, CFTC and “dozens” of federal and state agencies.

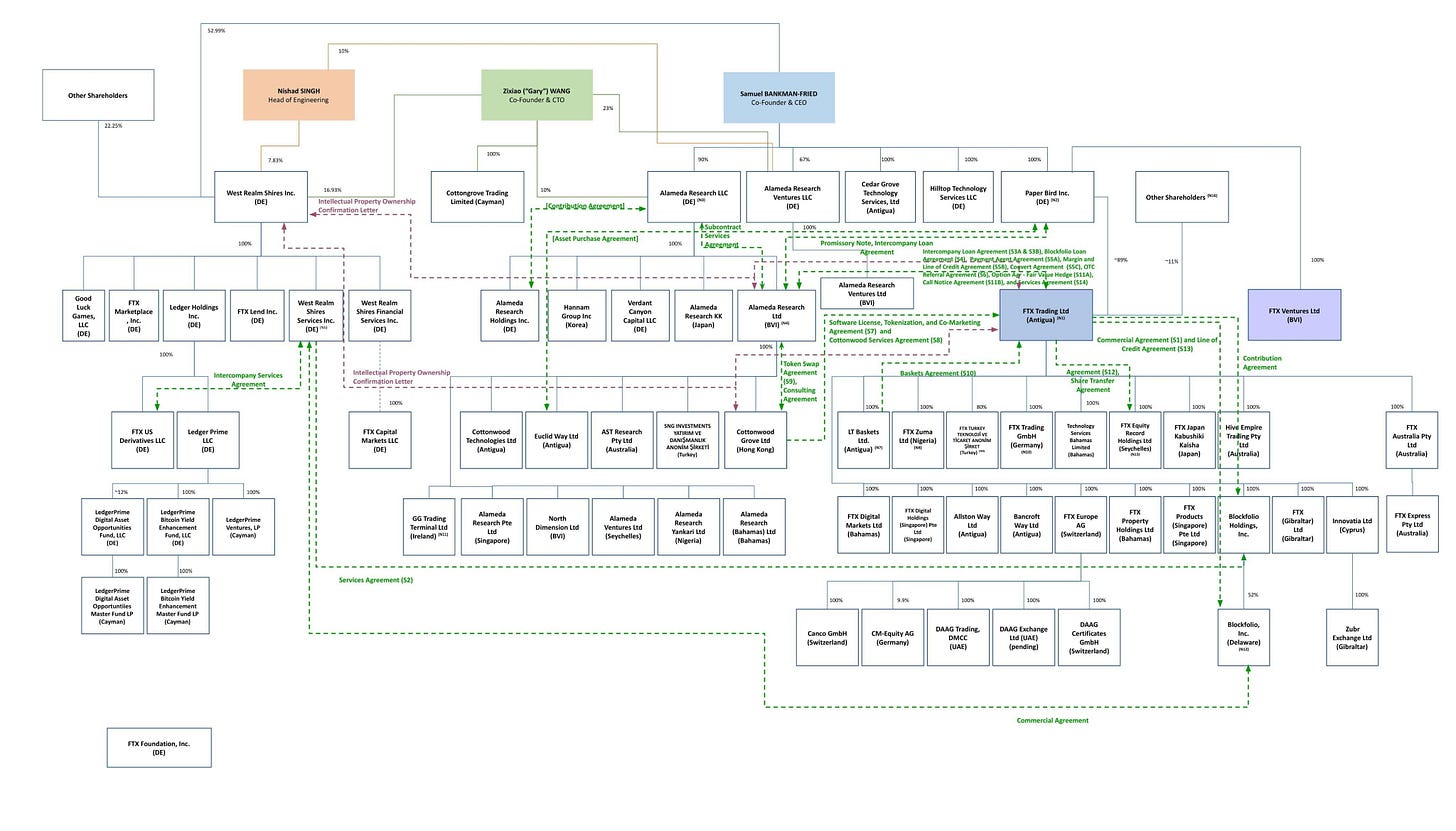

Somehow all of these top-tier VCs were cool with the fact that FTX didn’t even have a board. Hunh? Sure, SBF is only 30 years old, but, hey, Zuckerberg had been CEO for a decade at that age. Maybe the board would have discovered that SBF built secret back doors that would allow him to move customer money freely from FTX to Alameda without alerting others, including external auditors. "The exchange's founder Sam Bankman-Fried secretly transferred $10 billion of customer funds from FTX to Bankman-Fried's trading company Alameda Research” according to Reuters." Or perhaps the board might have wondered about a corporate structure that looked like this:

Instead, FTX will go down in the pantheon of collapses, a small sampling of which I’ve ranked here:

Bernie Madoff: Former chairman of NASDAQ and member of multiple SEC advisory committees ran a Ponzi scheme worth $65 billion. Roughly 81% was eventually recovered and returned to investors. Madoff died in jail.

FTX: ~$6 billion of customer funds lent out and lost.

MF Global: A derivatives brokerage run by Ex-Goldman CEO Jon Corzine loses $2 billion on EU gov bond bet then used $891 million in customer funds to cover the hole. After 7 years, investors got 93% back. Corzine became a U.S. Senator and Governor of New Jersey.

Elizabeth Holmes: Burned $700 million for fraudulent blood tests. Found guilty of wire fraud and conspiracy.

Crypto cleary attracts fraud. Some of crypto’s decentralized ethos makes this possible and regulators slow responses haven’t discouraged it. But just from history, I suspect that most of this is a byproduct of small, immature, and high-growth environments. Whether it’s railroads, automobiles, the first tech bubble, Enron or crypto, when there is lots of money being made in a new industry, scammers pour in and even perhaps legit operators get ahead of themselves. WeWork burnt through $12 billion and while you may think Adam Neumann was a lower-case “fraud”, he didn’t commit outright fraud and steal investor’s money.

2) This happened in crypto, but it was not crypto itself that failed.

People talk about DeFi vs. CeFi. DeFi is the catch-all for “decentralized finance” which is, bu definition, transparent and trustless. We talked last issue, for example, about DAI and how it is a DeFi version of the U.S. dollar that allows you to track assets and liabilities by the second. CeFi stands for “centralized finance.” These are companies that work in crypto, but operate like traditional financial companies. They will interact with on-chain products, but generally lack the transparency of DeFi.

CeFi plays a critical role in the crypto world. We need on and off ramps. And as much as some fringe element may not like it, we also need Know Your Customer and Anti-Money Laundering rules and enforcement. But virtually all of the failures in the crypto world have happened at the CeFi level: FTX, Voyager, Three Arrows, Celsius. They all gambled on high volatility products without their customers realizing what was going on all while escaping regulatory attention. Unregulated + opaque is the quadrant of despair in your crypto 2 x 2.

Regulated + opaque seems mostly fine: Coinbase and Kraken come out of this looking good so far. Even LedgerX which was owned by FTX, but regulated by the CFTC, seems to be OK.

But in the deFi world, unregulated + transparent has performed flawlessly. Uniswap, the decentralized, onchain version of FTX continues to work flawlessly and processed $23 billion in trades over the last seven days. Aave and Compound continue to issue and redeem loans just fine. And as crypto prices tanked, DAI calmly liquidated positions as required and kept plugging away.

Even FTX and Alameda couldn’t escape their DeFi obligations. For example, Alameda had borrowed $33.5 million of something literally called MIM: “Magic Internet Money” (their URL is abracadabra.money and their mascot is a cute cartoon wizard, I can’t make this up). On November 7, as things are imploding around them, Alameda chose to repay that loan, along with all of their short-term DeFi lending, before anything else.

Ultimately, many of the exact things that crypto was meant to solve (self-custody, transparency, trustlessness) are all of the things that would have prevented this from happening.

3) Contagion has been limited to this point, but fallout can take some time.

Reports are trickling in of various degrees of exposure to FTX and Alameda. There have been lots of “we’re been nicked, but we’re fine” Tweets and a handful more of “it’s just a flesh wound.” But we’ve come to the point in the cycle where no one believes what anyone says and everyone suspects the worst. This tightening of liquidity along with a drop in crypto prices prompted by the crises surely has other firms in desperate straights. Crypto.com came under immediate suspicion based on some odd transfers and users have been withdrawing heavily. I might have expected more immediate contagion given all of the stresses in the system in the last nine months, but I would not be surprised to see more come about.

◆ Where Do We Go From Here

What happens now? I would bet on three things: 1) more regulation, 2) institutions running away as fast as they can and 3) the crypto community continuing to build.

The U.S. regulatory environment has been a mess. The SEC (which regulates securities) and the CFTC (which regulates derivatives) have fought a low-key battle over who has jurisdiction over crypto. The SEC has been most aggressive, but has focused entirely on punitive punishment instead of proactive policies. They fined Kim Kardashian for not labeling a crypto ad, but still won’t give guidance on what is or isn’t a security. Don’t get me wrong, Kim shouldn’t be pushing stupid crypto scams to her unsuspecting followers, but I’d like to see a more proactive, effective regulation.

The very first topic of Crypto Curious discussed the SEC’s continuing denial of a Bitcoin ETF, despite the fact that regulators in Canada, Germany, Switzerland, France, Australia and Singapore have all approved spot ETFs and they all seem to trade just fine.

There's a reasonably strong argument that the lack of clear rulemaking has actively harmed U.S. investors by pushing so many things offshore where there is either no regulation or regulators are overwhelmed. Whatever you think of SEC effectiveness, they are a lot more sophisticated than Bahamian regulators.

SBF had apparently been working closely with the SEC, including a 45 minute Zoom with Commissioner Gary Gensler, to negotiate a special carve out for FTX. He was also a big advocate for the DCCPA, a controversial bill that would have brought heavy regulation to DeFi. In fact, it was his support of the bill in mid October that seemed to turn the crypto community against him. Meanwhile, Sam’s donations and cultivation of D.C. seemed to have paid off with the CFTC. The CFTC fined BitMEX $100 million, but didn’t go after FTX for offering basically the same product. Instead, Commissioner Caroline Pham Tweeted cute photos of her with SBF and joked about being jealous of his hair (all since deleted).

There’s already been a camp that has wanted to heavily regulate crypto and they now find themselves with some new ammunition. But the crypto community has become increasingly engaged in politics and this incident will surely encourage some participants to step up their activity in D.C.

In the meantime, the steady drumbeat of the last few years had been, “The institutions are coming.” Particularly around Bitcoin, we’ve seen institutions of various types start to nibble at investing in crypto. I think it’s safe to assume that those will slow dramatically or outright stop. If you’re a fund manager at a university or pension fund, job #1 is to keep your job. Even if crypto assets 10x from here, you’re not getting fired for missing out on that after FTX. But if crypto flatlines, you will for sure be out of work if you lose money in crytpo after one of the biggest frauds in history.

But despite it all, crypto will move on:

The term “Ponzi scheme” gets thrown around a lot these days. Charlie Munger and his fellow nonagenarians call Bitcoin and Ethereum Ponzi schemes because there is nothing “real” and that you only buy it so you can sell it to some greater fool. But apparently, once you are listed on a US exchange, this criticism no longer applies. Snap “sells” a product that literally disappears after 24 hours and their stock that is down 80% in the last year. I’m sure that all of the institutions that own Snap are planning to hold their shares until they start getting dividend payments and would never count on just selling their shares to some greater fool to return their investment.

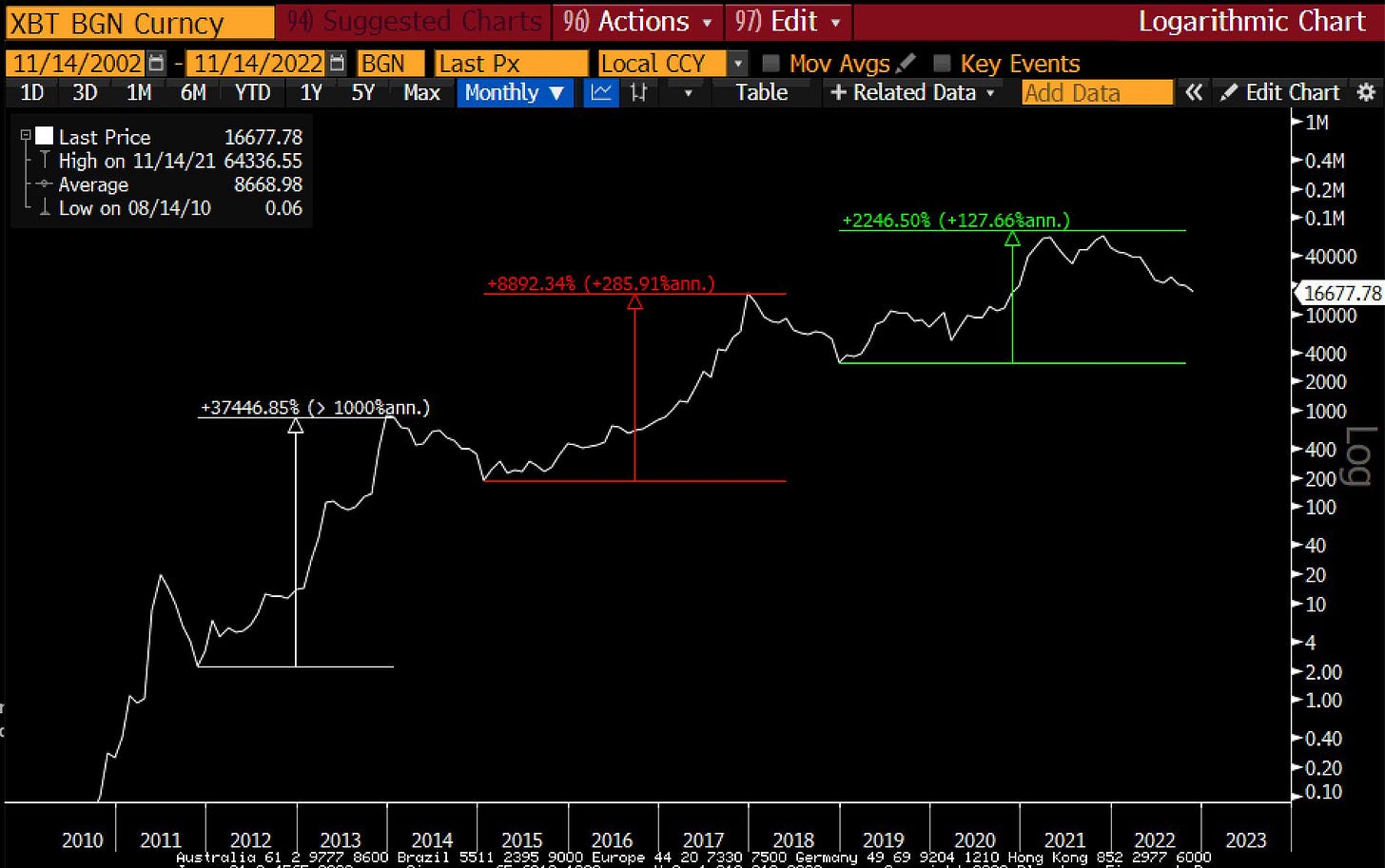

Of course the other term connected with crypto is “tulip bubble.” The difference here is that Ponzi schemes and tulip bubbles don’t come back once they have burst. Bitcoin has already died four times:

Once in 2011:

Once in 2013/2014:

Then I lived through it dying in 2018:

And then now:

But each new cycle seems to bottom right around the previous top:

Ethereum is younger, but has been similarly resilient. Most people don’t realize that the network has generated $5.4 billion in revenue in the last year from user fees. It’s not just pretend anymore.

As of today, things feel pretty grim. But the core aspects of the crypto revolution didn’t go anywhere in the last two weeks. Things like trustlessness, decentralization, composability, permissionless building, and credible neutrality are still massive building blocks.

With the one exception of nuclear (which has some pretty obvious risks), I can’t think of any technologies that were put back in the bottle after they reached some base level of adoption. The ranks of the crypto fans may thin in the next weeks and months, but there will remain a core, committed group that will continue to build. I may personally be more pragmatic, but this industry has long been driven by those that have a Messianic belief in the technology. Those oddballs and zealots and geniuses won’t be deterred because a 30-year-old schlub and his Bahamian polycule ran an enormous scam and stole $8 billion.

They will continue to build weird experiments, many of which will look stupid and most of which will fail, but some of which will become the foundation of the next cycle. I, for one, don’t plan on selling, don’t plan on leaving and can’t wait to see what gets built in the next decade.

This Week's Freezing Cold Take

“I have to disclose I’m a paid spokesperson to FTX… If there’s ever a place I could be that I’m not going to get in trouble, it’s at FTX.”

As always, thanks for reading. Send me questions and please share with your crypto curious friends.