Bitcoin Just Chillin' Over Here

Matt Levine, who writes the Money Stuff newsletter for Bloomberg, has long been one of my favorites and also an obvious inspiration for this newsletter. Last week, he dropped a 40,000 word masterwork on crypto: “Where it came from, what it all means, and why it still matters.” He’s superior to me on all known dimensions so I would consider going and reading that, but only once you’ve finished this newsletter.

🟢 Flat Is the New Up

(Big Idea: Digital Gold)

A month ago, we talked a bit about Bitcoin’s volatility and its progress to becoming “digital gold”. One of the ongoing complaints against Bitcoin has been its high volatility. I have argued that this is an artifact of it being very early in its journey and, as such, behaves like a “risk-on” asset. At 1/20th the market cap of gold, it is more prone to flows of capital and new pieces of news. Its volatility and its price discount reflect the probabilities that it may become digital gold vs. already being digital gold.

Given that, its price stability over the past few months has been interesting to note. In the past 30 days, Bitcoin has, in fact, been less volatile than the S&P 500:

When the markets started really tanking in April, Bitcoin went down with them and tracked similarly to other FinTechs like PayPal and Block (nee Square). But since mid June, Bitcoin has traded in a narrow range, bouncing right around $20,000.

Personally, I am more of a “buy and hold” believer and I tend to think most technical trading is disturbing close to horoscopes so I generally don’t pay a lot of attention to things like head and shoulders patterns. [Quick game: Which of these are technical trading terms and which are “adult” terms? Double Bottom, Island Reversal, Saucer, Blow Off, Wedge, Top Reversal, Broadening Bottom.] To be clear, I do not think that Bitcoin has reached a new, lasting stage of reduced volatility. I suspect this is mostly a blip, but there may be something to this trading pattern.

Some have speculated that there is mental significance to the $20,000 level. A) It’s a nice round number in U.S. dollar terms that makes it easy for people to anchor on. B) $20K was basically the all time high from the previous bull market phase that ended in 2017. While it would be dumb to say it can’t go any lower, it has started to feel like $20K may be a psychological floor for a number of Bitcoin hodlers. I think you can argue that for a long time, Tesla stock was propped up by zealots that believed in Elon or a greener world or both. There is certainly a strong vein of Bitcoin fanaticism and they may see this as a line below which they just won’t sell.

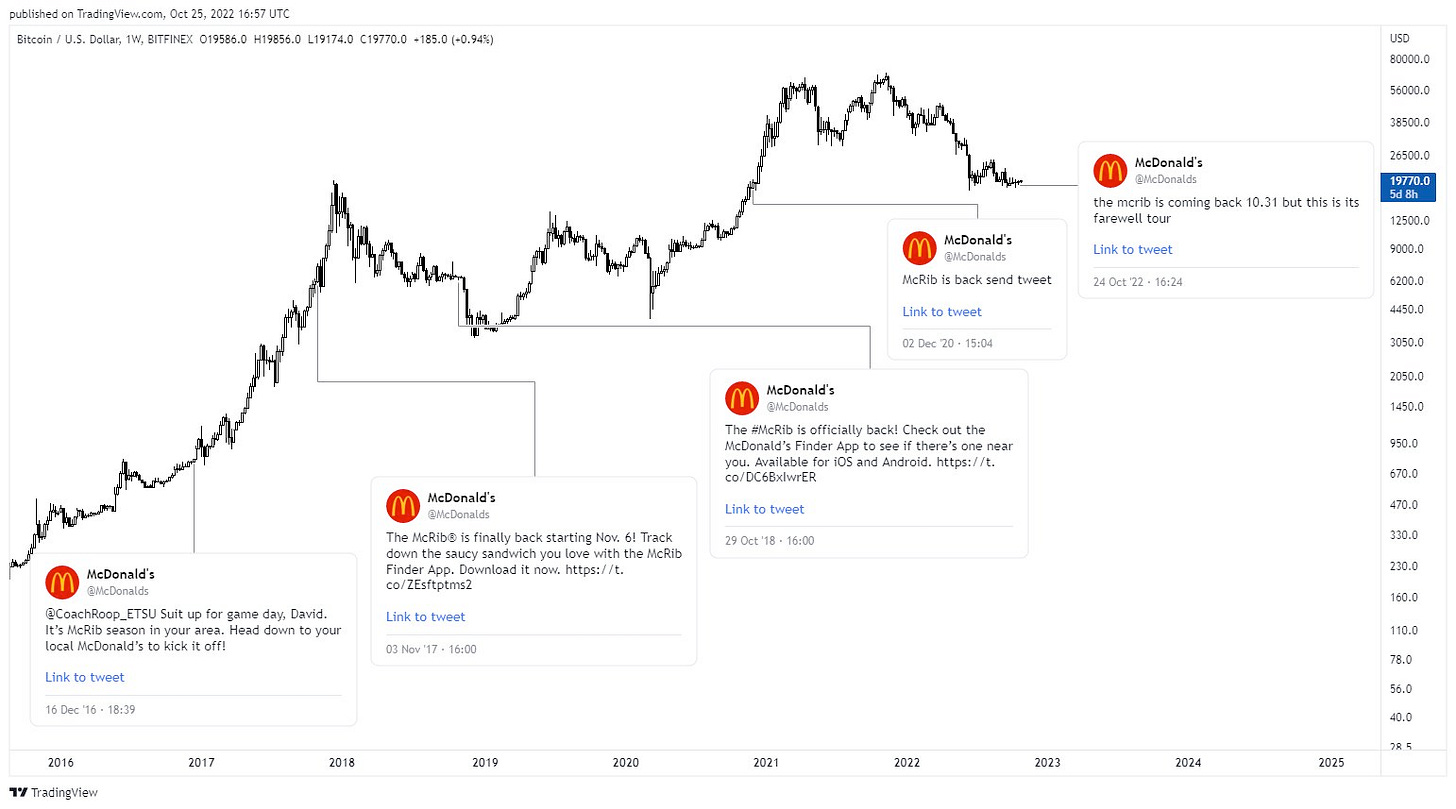

The other piece of interesting news? Every time McDonald’s brings back the McRib, Bitcoin goes up. Guess what taste treat is back on the McDonald’s menu as of yesterday.

🟦 The-Tech-That-Must-Not-Be-Named

(Big Idea: NFTs as Status)

We’ve also talked previously about Starbucks plans to launch NFTs, excuse me, “journey stamps” and how this “crypto mullet” (party in the front, crypto in the back) strategy of obfuscating the technology would be the model for future launches.

Well, while Starbucks was talking about it, Reddit just went out and did it. If you’re not a 13-29 year old male, you may not realize how popular Reddit is. It’s the 7th most visited site in the U.S. with 1.7 billion visits a month, so apparently that’s where all these dudes are hanging out since they aren’t out knocking boots anymore. Unlike Facebook and Instagram which use real photos as your avatar, on Reddit you have a cute cartoon avatar called a Snoo that you can customize in a number of dimensions. And as it happens, Reddit has also built a reputation as a particular nexus of hatred of NFTs.

Still, back in July, Reddit launched “Collectible Avatars” (AKA NFTs), for sale in a dedicated store. Then in August, they started “airdropping” (or giving away for free) avatars to some of the most active Redditors. Popularity started building, collections started selling out and by late October, they were a full blown phenomenon. 2.9 million users have collected avatars, there’s been over $10 million in transaction volume on secondary markets and the implied combined value of these new avatars checks in at $75 million.

The execution has been brilliant:

Reddit avoids calling them NFTs.

The avatars were launched in different collections, with different artists, styles and rarities. All were priced affordably between $10-100.

Only when you go to purchase or claim an avatar is a crypto wallet created to hold your avatar. Even then, it’s called a “Vault”, not a wallet. The process is seamless and you don’t need to interact with the blockchain technology if you don’t want to (the tech runs on Polygon, the same chain behind the Starbucks NFTs).

Credit cards are the only way to buy from Reddit. Only secondary markets use crypto.

Reddit doesn’t especially hide the fact that these are blockchain based, but it’s not front and center either. You can buy and transfer collectibles without ever leaving Reddit. But, the fact that they actually exist on an open chain enables additional functionality and power. Most simply, you can buy and sell outside of Reddit. If you missed out on the airdrops and all the collections are sold out, you can head to OpenSea to buy one or just to cash out the one you got airdropped. But you can also use the NFTs elsewhere: perhaps as your Twitter avatar or to get special access somewhere else.

Does any of this make Reddit NFTs a good investment or even something likely to stick long term? Almost certainly not as an investment and possibly not even a long term trend. But I guarantee you that all of the tiny social status indicators that exist in the offline world are coming quickly to the online world. This is just one of the early steps. The ancient Egyptians had three levels of mummification that corresponded to your social status and dictated, uh, how carefully your body was treated (this particular link is safe for work, but perhaps not right after eating lunch). The word “bigwig” literally comes from when nobles in the 1700s would pay the modern equivalent of $10K on dapper white wigs to look like a baller. And if my son is any indication, Panda Dunks are like powdered wigs for middle school boys on the Peninsula.

If an average Reddit user spends 15 minutes a day on the site, paying $20 for a cool avatar to stand out seems like a small cost.

◆ Duh Doi DAI

(Big Idea: On Chain Transparency)

We’ve briefly talked about stablecoins, but it’s worth diving deeper into Maker DAO and DAI today given some recent votes in the past week. We’ll start with how DAI is a pretty cool version of what crypto can enable in a relatively pure, on-chain form and then touch on some of the bigger complications lurking below.

Maker DAO is the organization that created DAI, a decentralized stablecoin. Stablecoins are crypto’s version of the dollar (or now Euro). Currently, it’s still pretty cumbersome to move back and forth between the traditional financial system and the crypto world. So once you have money in the crypto universe, it is helpful to have a representation of a dollar that doesn’t fluctuate in value. That’s a stablecoin.

Tether (USDT) and Circle (USDC) have versions of stable-coins that are “fiat backed”. This means that for every dollar that they create in the crypto world, they hold one dollar in the real world. With Tether, there have been persistent questions on whether or not this is 100% true. Circle, on the other hand, is U.S. based, highly regulated and even publishes the CUSIPs of the treasuries that it holds for a higher level of transparency. Some people really like that USDC is so tightly controlled, but the flip side is that as a fully regulated U.S. entity, it’s subject to the potential whims of U.S. regulation. When Treasury sanctioned Tornado Cash, all USDC within Tornado was made worthless by Circle.

DAI, on the other hand, is decentralized. The Maker Protocol, which sets policy, is itself a DAO or “decentralized autonomous organization” which right there is going to sound pretty soft and fuzzy to a lot of you from the get go. Putting the DAO aside, the value of DAI is set at $1 and that peg is maintained via over-collateralized lending. If you have crypto assets, you can deposit them and get DAI in return. The rates vary by asset, but, for example, Ethereum requires a 170% collateralization rate. Because it’s over-collateralized, however, the “interest rate” is very cheap, just 0.50%. This is essentially a crypto margin loan. Here’s an example:

I deposit 125 ETH, currently worth ~$200,000 at $1,576 per ETH.

I could then borrow up to a maximum of $116,000 worth of DAI ($200,000 / 170% collateralization rate). Instead, I will borrow $100,000 to leave me some buffer. 100,000 new DAI enter the world which I can use elsewhere in the crypto world or even pull it out via an exchange as a down payment on my Lambo. Hooray!

The health of my “vault” then tracks the price of my collateral, in this case ETH. If ETH goes up in price, all is good. In fact, if ETH doubles, my collateral is now worth $400,000. Since my loan is still $100,000. I could either remove some ETH from the vault or borrow more DAI. Two Lambos!

But, if ETH starts to drop, the opposite happens. I either need to add more ETH, repay some of the loan or I will automatically get liquidated. In this case, if the price of ETH drops below $1,360, essentially, my ETH gets sold off to pay off my $100,000 debt, I get charged a 13% liquidation fee and my loan is closed. Anyone want to assume a lease on a Lambo?

One of the beauties of this system is that it is all completely transparent. If you’re worried about the stability of your DAI, you don’t have to trust Tether to tell you they have $69 billion in a bank account, you can actually see all of the collateral backing DAI. Sites like DaiStats show the composition of the collateral, the current health and virtually everything else you would need to know to trust that DAI is stable:

You can even peer into individual vaults. Here is a user who deposited over 60,000 ETH and borrowed $1 million in DAI to start. As the value of ETH went up, they pulled more and more DAI out. Over time, they have withdrawn $30 million in total and currently have $26.6M in DAI debt against $95.8 million in ETH collateral.

Imagine Wells Fargo doing this! Or perhaps Credit Suisse right now. Or Lehman in 2008. No need to share names on the loans, but what if you could know verifiably the state of your bank’s entire loan book? Dude, it’s stuff like this that blows my mind.

Oh, and you don’t need to go into a bank branch to get a loan. At “easy” level, you just go to Oasis.app, instantly connect your wallet that holds your collateral, and in seconds you get virtual dollars. On “medium” difficulty, you don’t even go to the website, your code just does it for you. Since this is a decentralized, trustless service, anyone in the world can interact with the protocol directly via code to open or close loans, adjust collateral, or put in stop losses all 100% programmatically. Meanwhile, it took Schwab 5 years of work to build an “Open Account” page that was legible on a mobile phone.

Now there’s any number of issues that will pretty quickly crop up with this amazing technology. You can go in multiple directions, but it’s the issues that Maker itself has dealt with that have come up in the past week. Just like old world banks, Maker’s ability to create dollars is limited by its ability to get assets to lend against. And the over-collateralization required by their model greatly limits borrowing demand.

But Maker is a DAO so all major decisions are made by the community in some form of voting. Some of these are on the simpler side. DAI is backed by about $3.4 billion of USDC so a recent vote was ratified to allow Coinbase to custody $1.6 billion worth of USDC in return for 1.5% interest. That would generate $24 million in income each year for Maker which is a lot more than zero they currently earn on that USDC just sitting there.

Other recent issues put up to a vote are more contentious. Should Maker reduce their exposure to USDC given that USDC itself is so centralized? Should Maker be backed by real world assets (RWA) like US treasuries and corporate bonds? Should Maker split into multiple sub DAOs? These would be complex issues for any company to grapple with in a rapidly changing and challenging regulatory environment. And, in fact, what we have seen play out is basically a lot of VCs do with early stage companies: let the founder decide.

Last week’s votes had low turnout, like any shareholder vote, and the votes that were cast widely supported Rune Christensen, Maker DAO’s founder. Any time there is a new technology, people tend to idolize the upside, before gravity seems to eventually sets in. That’s how we went from “social media will unite the world; Arab Springs for everyone!” to “Cambridge Analytica ruined an election.” Personally, I don’t think democracies are especially good ways to run complex corporations. DAOs sound pretty cool in theory, but I suspect that over time will we see more and more DAOINOs (DAOs in name only).

This Week's Freezing Cold Take

“The growth of the Internet will slow drastically, as the flaw in ‘Metcalfe’s law' becomes apparent: most people have nothing to say to each other! By 2005, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

Paul Krugman, Nobel Prize Winner, in 1998.

As always, thanks for reading. Send me questions and please share with your crypto curious friends.